Introduction to Chartered Accountancy (CA)

Becoming a Chartered Accountant (CA) in India is a prestigious and rewarding career path. CAs play a crucial role in the financial sector, providing services ranging from auditing to taxation consultancy. In India, the Institute of Chartered Accountants of India (ICAI) regulates the CA profession, ensuring its standards and ethics.

Eligibility Criteria for CA Course

To pursue the CA course in India, one must fulfill certain eligibility criteria. This includes having completed 10+2 schooling from a recognized board and registering for the CA Foundation course with the ICAI.

CA Course Structure

The CA course is divided into four stages: Foundation, Intermediate, Articleship Training, and Final. Each stage has its own set of examinations and requirements that aspiring CAs must fulfill.

Registration Process for CA Course

Aspiring CAs need to register with the ICAI to commence their CA journey. This involves online registration for the Foundation course and subsequent registrations for the Intermediate and Final courses upon clearing each level.

CA Course Examinations

The CA examinations are known for their rigor and comprehensive coverage of accounting, auditing, taxation, and other related subjects. Aspirants must prepare diligently and stay updated with the syllabus and examination pattern.

Articleship Training

Articleship training is a mandatory part of the CA course, providing practical exposure to aspiring CAs. Securing articleship under a practicing CA firm or an organization approved by ICAI is crucial for gaining real-world experience.

CA Final Examination

The CA Final examination is the ultimate test of an aspirant’s knowledge and skills. Proper preparation, including rigorous study schedules and mock tests, is essential to ace this examination.

Membership of ICAI

Upon successfully completing all stages of the CA course and clearing the final examination, aspirants become eligible for membership of ICAI, granting them the prestigious title of Chartered Accountant.

Job Prospects for CAs in India

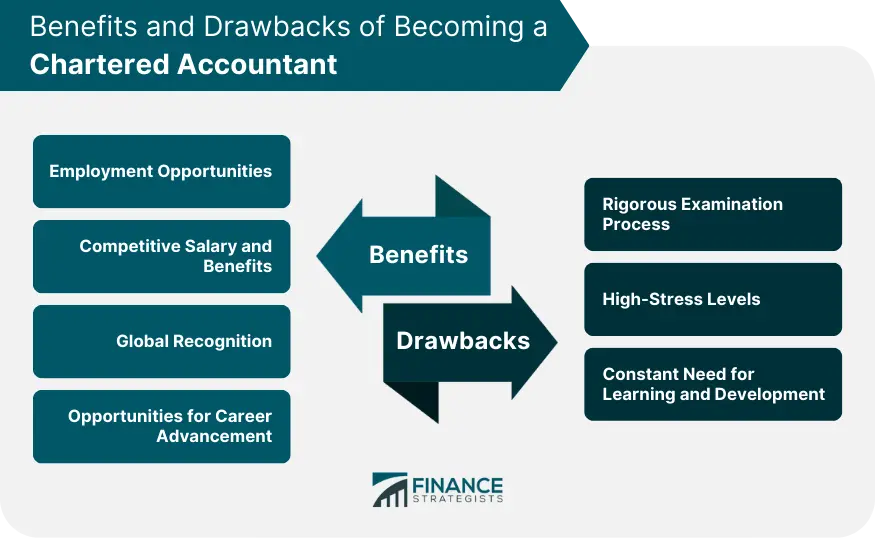

CAs have diverse career opportunities in India, including roles in audit firms, corporate finance, taxation consultancy, and government agencies. The demand for skilled CAs remains high, offering lucrative salary prospects and career growth.

Challenges Faced by CA Aspirants

Becoming a CA is not without its challenges. From the rigorous examination process to the demanding articleship training, aspirants may face various obstacles. However, with dedication, perseverance, and proper guidance, these challenges can be overcome.

Conclusion

Becoming a CA in India is a journey that requires commitment, hard work, and determination. However, the rewards of this profession, both in terms of personal satisfaction and career growth, make it a highly sought-after career choice for many.

FAQs

- How long does it take to become a CA in India?

- The minimum duration to become a CA in India is around 4.5 to 5 years, including the articleship period.

- Is coaching necessary for clearing CA exams?

- While self-study is possible, many aspirants opt for coaching to supplement their preparation and ensure better understanding of complex concepts.

- Can I pursue CA along with other courses?

- Yes, it is possible to pursue CA along with certain degree courses, provided one manages their time effectively.

- What is the passing percentage for CA exams?

- The passing percentage for CA exams varies each attempt, but generally ranges from 10% to 15%.

- Are there any age restrictions to become a CA in India?

- No, there are no age restrictions for pursuing the CA course in India.

Leave a Reply